MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields were all up big this week.

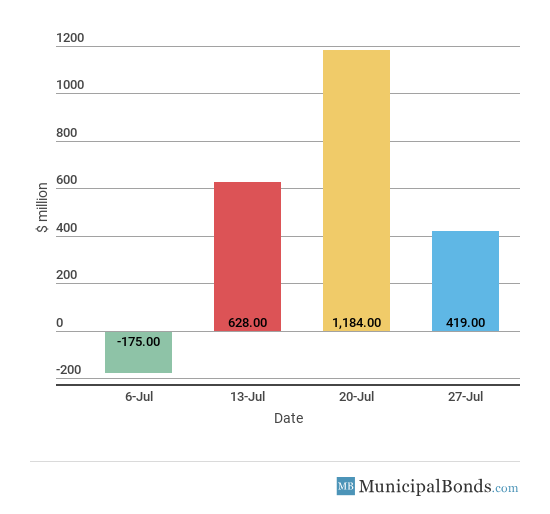

- Muni bond funds saw inflows for the third week in a row.

- Be sure to review our previous week’s report to track the changing market conditions.

GDP Hits Four-Year High

- GDP data was released on Friday with a quarter over quarter change of 4.1%. This was slightly lower than the consensus of 4.2% but it was the best measure in over four years. The strongest component was consumer spending, up 4.0%. Net exports was the second largest contributor, adding 1.1% to the net total.

- The second-to-last FOMC meeting takes place next week and the Fed is expected to announce that the economy is heading toward its goal of 2.0% for inflation and that another rate hike will either happen this meeting or the next meeting in September.

- Consumer Sentiment came in at 97.9, higher than the expected 97.1. This measure is a good report pointing to a healthy consumer who, unlike the Federal Reserve perhaps, is not concerned about inflation.

- Jobless claims saw a gain of 9,000 this week to a total of 217,000, which was still lower than the consensus amount of 219,000. The four-week average decreased this week, bringing the total to 218,000, which also remains around record-low levels.

- The Fed’s assets decreased by $13.9 billion this week, bringing the total asset base to around $4.278 trillion.

- During the week, money supply (M2) increased by $20.0 billion, a reversal of last week’s decreasing trend.

Keep track of economic indicators that might impact the muni market.

Treasury and Municipal Yields Both Increase

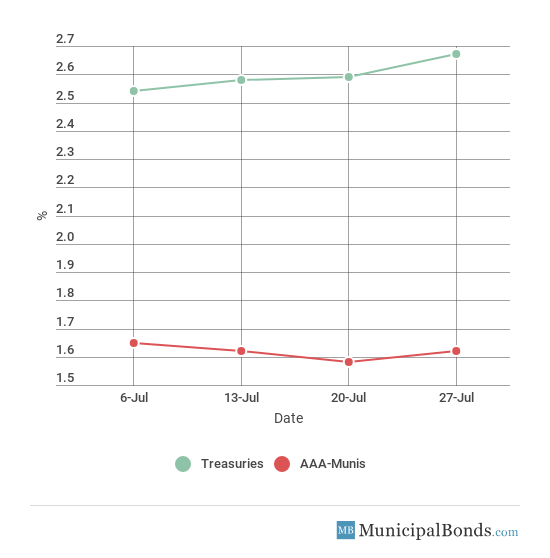

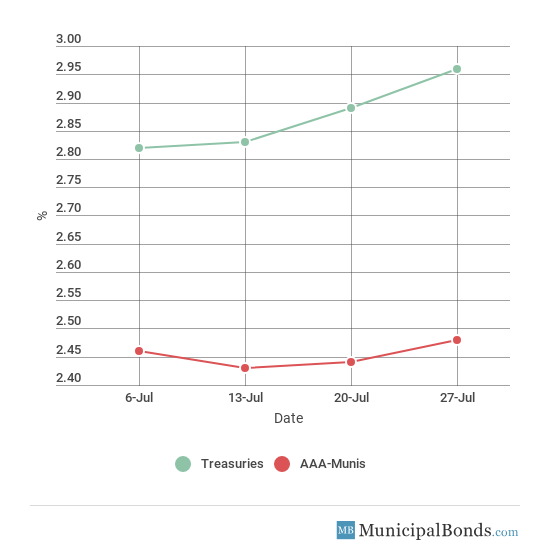

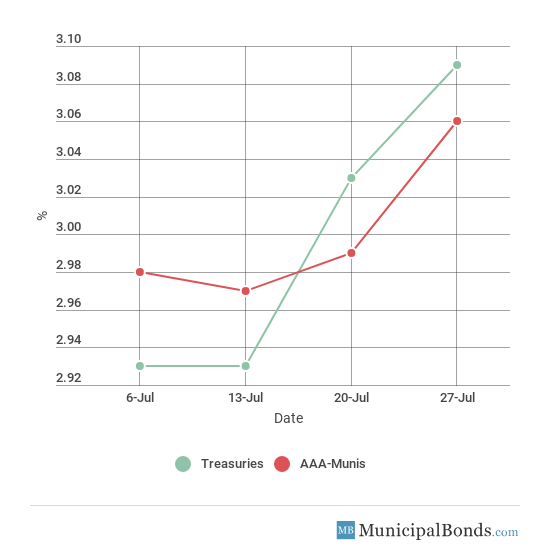

- Treasury yields saw big gains for the second week in a row, with the 2-year Treasury having an increase of 8 bps to yield 2.67%. The 10-year Treasury had an increase of 7 bps and now yields 2.96%. The 30-year Treasury yield had an increase of 6 bps and now yields 3.09%. Municipal yields were also up this week with the 2-year AAA-rated bond gaining 4 bps to yield 1.62%. The 10-year AAA-rated bond increased by 4 bps to yield 2.48%, while the 30-year AAA-rated bond increased 7 bps to yield 3.06%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond widening up to 105 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.67% | 1.62% | 105 |

| 5-year | 2.84% | 1.97% | 87 |

| 10-year | 2.96% | 2.48% | 48 |

| 30-year | 3.09% | 3.06% | 3 |

Muni Bond Funds See Third Week of Inflows

- Municipal bond funds saw its third week in a row of inflows, with assets under management increasing by $419 million.

New Jersey Transportation Trust Fund Authority Issues Revenue Refunding Notes

The largest issue of the week comes from the New Jersey Transportation Trust Fund Authority that issued over $1.195 billion of Federal Highway Reimbursement Revenue Refunding Notes. The NJ Transportation Trust Fund Authority plans, acquires, engineers, constructs, repairs and rehabilitates the state’s transportation system, with a particular focus on state highways. The bonds are rated A- by Fitch, Baa1 by Moody’s and A+ by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades County of Ohio, Kentucky (Big Rivers Electric Corporation Project) to Ba1; rating outlook revised to stable: Moody’s upgraded County of Ohio in Kentucky to Ba1 from Ba2 due to the Big Rivers Electric Corporation (BREC) recently showing stronger financial metrics paired with a supportive regulatory environment. The upgrade affected $83.3 million in bonds that are called Pollution Control Refunding Revenue Bonds.

Downgrade

Moody’s downgrades Charlotte Public Schools, MI’s GO to A2: Moody’s downgraded $26.6 million of Charlotte Public Schools in Michigan this week. These bonds are general obligation unlimited tax (GOULT) debt and were downgraded due to the district’s falling enrollment, which has led to the area seeing its credit tighten and debt levels elevate.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.