MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields mostly saw increases this week.

- Muni bond funds are back to inflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed Expected to Raise Rates Again

- The Job Openings and Labor Turnover Survey (JOLTS) came in higher than expected at 6.698 million versus the consensus of 6.543 million. An increase in this measure, over the last few months, suggests that employers aren’t finding sufficient candidates.

- The Federal Open Market Committee meets on Tuesday, June 12 and consensus has the committee raising the federal funds rate by 0.25%. In addition to this increase, the Fed is expected to reduce the level of bonds held on its balance sheets to around the $3.5 trillion level.

- The Bloomberg Consumer Comfort Index saw a drop to 54.8, which suggests that the view of the economy over the last few months has been weakening.

- Jobless claims saw a decrease of 1,000 this week to a total of 222,000, which was lower than the consensus amount of 225,000. The four-week average increased this week, bringing the total to 225,500, but it is still hovering around record-low levels.

- The Fed’s assets decreased by $8.3 billion this week, bringing the total asset base to around $4.319 trillion.

- During the week, money supply (M2) increased by $32.9 billion, a continuation of last week’s $34.3 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasury & Municipal Yields Mostly Increase

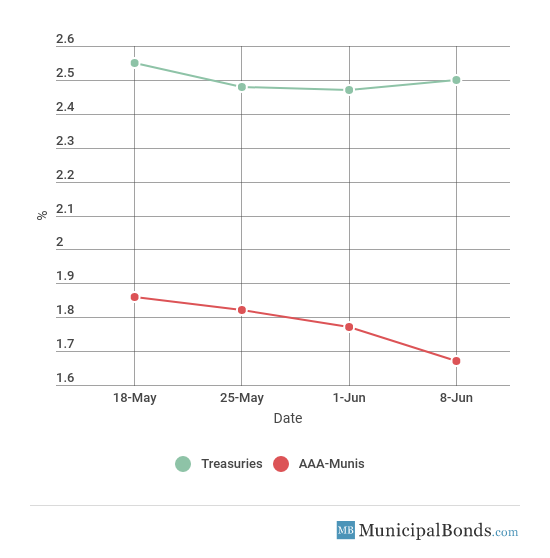

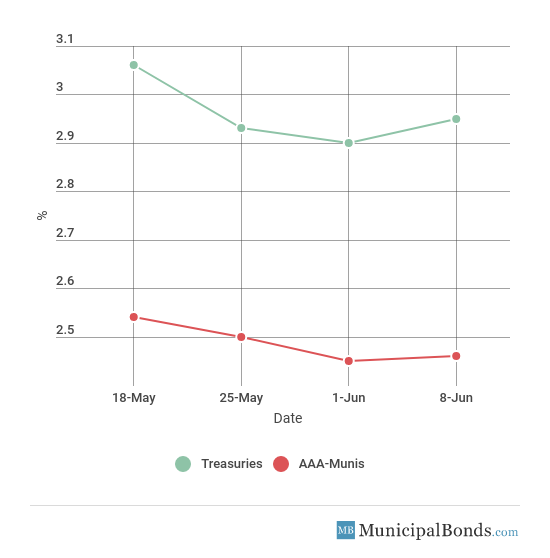

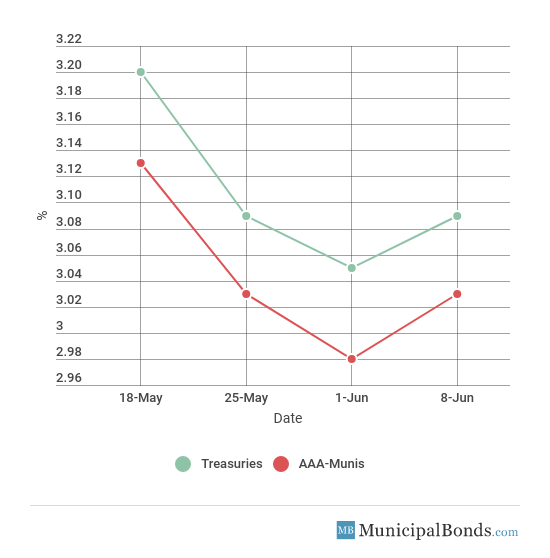

- Treasury yields all saw gains this week, with the 2-year Treasury increasing 3 bps to yield 2.50%. The 10-year Treasury had an increase of 5 bps and now yields 2.95%. The 30-year Treasury yield increased by 4 bps and now yields 3.09%. Municipal yields were also up this week with the exception of the 2-year AAA-rated bond, which fell 10 bps to yield 1.67%. The 10-year AAA-rated bond increased by 1 bps to yield 2.46%, while the 30-year AAA-rated bond also increased 5 bps to yield 3.03%.

- Credit spreads increased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 78 bps. Meanwhile, the spread between the 30-year securities increased to 7 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.47% | 1.77% | 70 |

| 5-year | 2.78% | 2.00% | 78 |

| 10-year | 2.90% | 2.45% | 45 |

| 30-year | 3.05% | 2.98% | 7 |

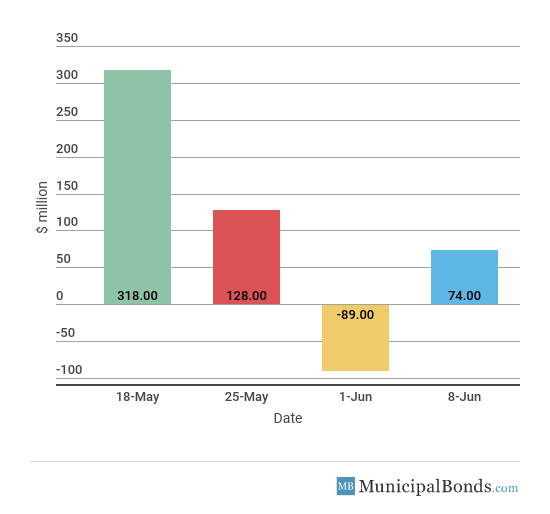

Muni Bond Funds Back to Inflows

- After seeing $89 million of outflows last week, muni bond funds returned back to inflows of $74 million this week.

California Municipal Finance Authority Issues Senior Lien Revenue Bonds

The largest issue of the week comes from the California Municipal Finance Authority, which issued over $1.18 billion in senior lien revenue bonds. There are two different issues: the Series 2018A, which consists of $1.16 billion, and Series 2018B, which consists of $19.37 million. The project is funding the LAX Integrated Express Solutions (LINUX) Automated People Mover (APM) System, which is a 2.25-mile long, elevated dual-guideway. The system will accommodate up to nine trains that are up to 175 feet long and approximately 50 passengers and their luggage. The bonds are rated BBB+ by Fitch.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Big Hollow School District No. 38, IL’s GOULT rating to Baa2; outlook positive: The Big Hollow School District No. 38 of Illinois had its general obligation unlimited tax bonds upgraded to Baa2 from Baa3 this week. The rating upgrade affects $16 million of the school district’s outstanding debt and was warranted due to a strong financial position.

Downgrade

Moody’s downgrades Pearl, MS to Ba2; outlook stable: Moody’s downgraded the CIty of Pearl, Mississippi’s general obligation bonds to Ba2 from Ba1. The City has struggled with its short-term liabilities due to a faltering development project, which has caused the City’s liquidity to shrink.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.