With the hike in the Fed funds rate on December 16 due to strong economic growth in the U.S., and the strong returns of municipal bonds this year, there is a sense of fear among investors on how the rate hike is going to impact muni bonds in the future. This article argues that muni bonds can still be a positive investment for those looking to invest in the fixed-income market.

As per the experts in the market, the hike in interest rates will do little to knock muni bonds. Usually an investor buys municipal bonds from a safety and tax-exempt income perspective. Thus there is always a lingering fear about its future performance in case of rate increases. But as per industry analysts, the market is still muni-positive.

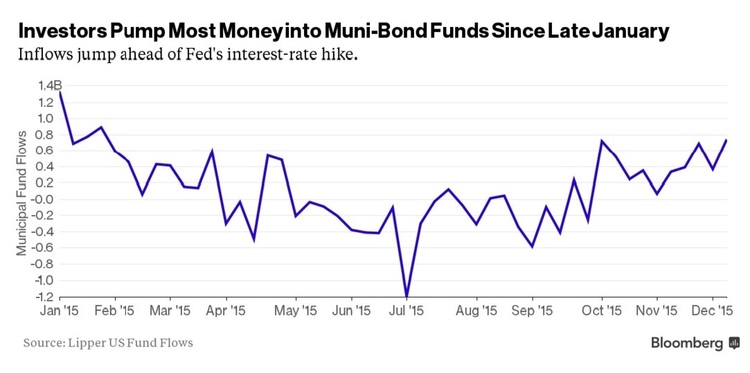

There has been a tremendous fund flow into muni funds since the start of this year, which has resulted in defaults falling for a fifth consecutive year. States and cities are being aided by an influx of tax revenue. Demand for munis has been tremendous as per the market analysis. The total value of the muni market is approximately $3.7 trillion, which has resulted in a return of 3.1% this year; the second straight year of annual gain. More than $3 billion has flooded into long-term muni funds over the past 10 weeks.

Fed Rate Hike

The FOMC announced the new target range for the federal funds rate at 0.25% to 0.5%, up from zero to 0.25%. This is the first rate hike since 2006 and overall bond markets have been long preparing to raise interest rates. When the Fed was increasing rates from 2004 to 2006, munis maturing in 22 years or more saw annual returns of 6.5%. This indeed signals that a gradual tightening of monetary policy may be beneficial to certain segments of the market.

As per the current market yield curve, it is expected that the Fed would raise rates to about 2.375% by the end of 2017. Given this scenario, according to various analysts, muni bonds are still expected to provide positive returns on almost all annualized bonds. Even if the Fed plans an aggressive rise in rates, returns would still be positive, except for a couple of long-term maturities (15- and 30-year) bonds.

Whenever there is a rate hike, bond prices decline and yields increase. But then there is a natural gain on bond prices as they move closer to maturity, which offsets more than the price decline. Investors should be ready to expect negative returns for some months to achieve this positive offset. With the rise in interest rates there will surely be an increase in yield. In the more likely market scenario, municipal bonds with 15- and 30-year maturities have the highest returns.

The Bottom Line

Citigroup Inc. projects that issuance will rise to $413 billion from about $397 billion this year. State tax revenue rose by 6.8% in the second quarter from a year earlier. As per the current market conditions, there is a strong demand for muni bonds and issuance is low, which favors the situation for muni investors. It is favorable to buy the bonds with the highest returns (i.e. long-term maturities) but as a part of portfolio it is always better to have some short-term maturity bonds in hand because they will perform better when rates are stable. It is believed that municipal bonds will continue to provide stability and income on which investors can rely.