The debt issuances for many educational institutes have been an integral part of municipal market diversity in the U.S. In addition, the private education sector has provided lucrative investment opportunities for many fixed-income investors.

However, in recent times, small or private institutions have faced serious financial strain on their operations due to a decline in student enrollment levels and reductions in tuition cost to remain competitive. The decline in student enrollment can be attributed to rising student debt, difficulty for graduates in finding jobs after graduation, and alternate forms of education in the form of trade schools and online education. The drop in enrollment rates impacts tuition revenues – often the pledging source for many bond issuances – and can potentially impact an issuer’s ability to meet debt service obligations.

In this article, we will take a closer look at the business model for private colleges, their changing financial conditions and the impacts on existing or prospective muni bond investors interested in the private college debt space.

Go through the key tenets of the due diligence process required for municipal bonds here.

Private College Business Model

As elite and out-of-reach as it may sound, private education has been one of the strong pillars of education in the United States. The educational model of private institutions for higher education is closely tied to enrollment numbers and driven by the private education business model to generate enough tuition revenues to cover costs.

In recent times, both private and public higher education institutes have widely accepted the idea of online learning, which is beneficial to both the institute and the student community in terms of cost savings. The online model has put a dent in the additional revenue segment for the school that was often derived from things such as campus housing and food. Although published tuition prices are on the rise for many private universities, net tuition dollars are falling. Net tuition determines the revenues generated by any private college.

The Growing Trend of Tuition Discounting

The global recession, paired with discouraging stories about student debt, the inability of graduates to find jobs related to their degrees and the socioeconomic state has caused a lot of students and their parents to reevaluate their financial investment in higher education and, at times, shift towards more cost-effective options, including trade schools and online education.

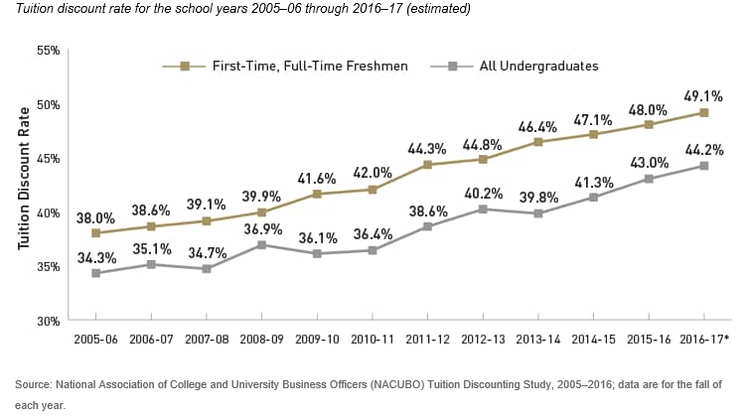

In the traditional system, students who can afford to pay for higher education are often subsidizing the ones who cannot afford to pay for college. Government subsidies also come to the rescue to a certain extent in this context. The private college education business is built around attracting students based on their merit and providing tuition help to those who meet that merit criteria. Private institutions are aware of the fact that providing some merit-based financial aid to students who would probably go to college anyway can generate more revenue than offering a full ride to a student who couldn’t pay for college. The double whammy of low enrollments and being forced to discount tuition fees has caused some colleges to go belly-up. The National Association of College and University Business Officers (NACUBO) aptly demonstrates this uptrend in the chart shown below.

Check out the different ways to invest in muni bonds to stay up to date with current investment strategies.

Potential Impacts on Muni Bond Investors

As average students and their families are facing staggering student debt, rising tuition costs and stagnant financial aid for higher education, students are opting to delay their higher-education dreams more than ever before. In addition, those who have acquired higher education are delaying buying big items like homes and cars, as student debt payments add a significant financial strain on their savings.

These are some of the key parameters that investors should keep in mind while considering the decision to invest in private college debt.

- Investigation of the revenue source: Investors can potentially eliminate some risk by simply knowing the backing of their municipal bond – for example, tuition revenues. Some colleges can use their building or land as collateral to pay for their obligations. In this case the debt is more secured than debt simply backed by tuition revenues. In addition, bond insurance can serve you well in the event of default.

- Understand the underlying credit rating: Most credit rating agencies stay on top of their ratings and make continuous efforts to engage with issuers on their financial health. Investors should keep their eyes out for any ratings upgrades or downgrades for their instruments and know the rationale behind any rating decision disclosure.

- The level of deferred maintenance: As financial strain increases, most organizations put off their efforts to maintain their buildings. This can seen as a liability for the entity and should be considered in your evaluation.

- Trend in tuition discounts: Merit scholarships and the tuition subsidies are on the rise. Investors should pay close attention to issuers and look closely at the year-over-year increases to their discounts and compare that to enrollment increases or decreases. Any major disparity can be cause of credit concern.

Keep our municipal bond glossary handy to get familiarized with the various terminologies used by the market participants.

The Bottom Line

Fixed-income investors in the higher education municipal debt market should be cautious when investing in debt backed by private education institutes, and carefully review their annual financial records to gauge their strength to meet short- and long-term liabilities. Where tuition discounting is on the rise and has become imperative for smaller colleges to attract students to maintain their enrollment numbers, it’s not a long-term, sustainable fix. Investors should closely monitor the credit quality and enrollment numbers of issuers to ward off any default risk.

Be sure to visit our Market Activity section to explore recent muni bond trades.

By becoming a Premium member, you can get immediate access to all the latest Moody’s credit reports for municipal bonds across the U.S. and enhance your analysis for a specific security.