One of the biggest draws to the municipal bond market is their tax-free status. Issued by states and local governments, Uncle Sam cuts muni investors a break and allows their interest payments to be tax-free. And in many cases, they are also exempt from state and local taxes. As such, municipal bonds are often a popular choice for taxable accounts and high-income individuals.

However, not all municipal bonds are the same.

There is a growing ecosystem of taxable municipal bonds. While this may seem counterintuitive, these taxable munis offer a variety of benefits to investors, including increased income and reduced portfolio risk. In many cases, taxable munis could be a better buy than corporate bonds with similar durations. With that in mind, taxable munis could be a great addition to a fixed-income portfolio.

Wait, My Muni Is Taxable?

The hallmark of municipal bonds has been their tax-free yields. Since 1913, municipal bondholders have enjoyed coupon payments free from federal income taxes. This tax exemption was designed to help state and local governments enjoy a lower cost of capital for their funding and borrowing needs. Additionally, states and local governments often offer tax breaks to their residents for these munis.

With this in mind, municipal bonds have long been portfolio holdings for many high-net-worth families, insurance companies and institutional investors. However, in recent years, regular and lower-income earners have also befited from the high taxable-equivalent yields and strong credit quality offered by munis in their portfolios.

It is strange to think that there is a growing portfolio of fully taxable assets in the $4 trillion muni market.

Starting in the mid-1980s, the federal government restricted the types of projects state governments could fund with tax-free municipal bonds. It wasn’t until 2009 that taxable munis took off, thanks to the American Recovery and Reinvestment Act and the Build America Bond program. The Tax Cuts & Job Act of 2017 included legislation that prohibited municipalities from issuing tax-free bonds for debt restructuring, shifting these pre-refunding transactions onto the taxable side.

All of this created a huge market for taxable municipal bonds.

What’s the Point?

For many investors and financial advisors, the thought of “what’s the point?” could be going through their heads. After all, the appeal of munis is that tax-free interest. Why mess with taxable munis in the first place? How do better returns, higher yields and a chance to de-risk a fixed-income portfolio sound?

First, let’s talk about taxable muni bonds with strong income potential. Tax-free munis often have low yields because of the tax break, producing a taxable equivalent yield after factoring in taxes. But, because they don’t offer such a break, taxable munis often pay higher yields. In fact, on average, taxable munis pay rates above investment-grade corporate bonds because they are less popular and face pricing inefficiencies, allowing investors to potentially secure better yields. Also, taxable doesn’t necessarily mean fully taxable. Interest from a taxable muni is federally taxable, many states do not impose additional taxes. So, if you’re a resident of California and you purchase a state-issued taxable muni, you’ll owe federal taxes but not California state income tax, which can further enhance yields.

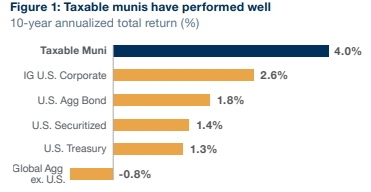

Those higher yields have provided taxable munis with some very strong total returns, outperforming other investment-grade bonds over the last decade. This chart from New York Life shows that taxable munis have beaten IG corporates, the broader bond market, Treasuries and MBS bonds. As for traditional tax-free munis? Taxable munis have beaten them as well by an average of 2% per year over the same period.

Source: New York Life

Perhaps the most interesting piece is that taxable munis are less risky than corporate bonds for that higher yield.

Just because they are taxable doesn’t mean they are somehow backed differently than tax-free municipal bonds. Many are backed by a state’s taxing authority or the revenues generated by a specific project. Because of this, taxable munis have had very low default rates, just like traditional bread-and-butter municipal bonds.

Because of this, more taxable munis carry higher crediting ratings. According to New York Life, 77% of taxable municipal bonds are rated AA or higher compared to just 9% of global investment-grade corporate bonds. Moreover, taxable munis have experienced far lower rating volatility.

This higher rating, low default rate and lower volatility of rating changes allow investors to de-risk their fixed-income portfolios while getting a high yield. Switching out some corporate bond exposure for taxable munis can reduce a bond portfolio’s risk profile. This is a huge win for conservative investors and those near or in retirement.

Taking a Taxable Muni Approach

With the benefits of taxable munis and the ability to de-risk a bond portfolio while still providing a high yield, investors may want to consider these bonds. Perhaps the only problem comes down to getting your hands on taxable munis. Already, buying individual muni bonds is hard. Given the small size of the taxable muni segment, buying individual issues is nearly impossible.

Which means we are looking at funds — and even here, this could prove difficult.

There is only one ETF that covers the sector, the $1 billion Invesco Taxable Municipal Bond ETF (BAB). It tracks the ICE BofAML U.S. Taxable Municipal Securities Plus Index, which holds various taxable muni debt, such as Build America Bonds and other refinanced debt. For most investors looking to add a dose of taxable munis, this is the best way to go.

There are a few closed-end funds (CEFs) covering the sector. CEFs are quirky, but investors may be able to get larger yields and discounts to the fund’s underlying NAVs with smart trading and timed buys.

Taxable Muni Bonds ETFs

These funds were selected based on their exposure to the taxable municipal and Build America bond sectors. They are sorted by their YTD total returns, which range from -2.3% to 2.3%. They have expenses between 0.28% and 2.63% and assets under management between $367M and $1.53B. They are currently yielding between 4.1% and 10.05%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| BAB | Invesco Taxable Municipal Bond ETF | $1.53B | 1.2% | 4.1% | 0.28% | ETF | No |

| GBAB | Guggenhm Txble Mcpl Bnd & Invt Gd Dt Trt | $367M | -0.8% | 10.05% | 1.34% | CEF | Yes |

| BBN | Blackrock Taxable Municipal Bond Trust | $1.11B | -2% | 7.4% | 1.84% | MF | Yes |

| NBB | Nuveen Taxable Municipal Income Fund | $499M | -2.3% | 7.5% | 2.63% | CEF | Yes |

Taxable municipal bonds are often overlooked in the fixed-income space, but they offer strong credit quality, high yields and better total returns. They can be a great way to de-risk a bond portfolio and boost income. While the options to add them are limited, they feature robust assets and substantial trading volumes.

Bottom Line

Not all municipal bonds are tax-free, but that should not dissuade investors. Taxable munis have the potential to provide greater benefits and income than their tax-exempt counterparts. For investors, incorporating them into a bond portfolio can help reduce risks and enhance income potential.