The municipal bond market may be known for its rock-solid stability, but bond insurance can provide peace of mind when turbulence arises.

Detroit’s 2013 bankruptcy forced bondholders to take a 26% haircut on unlimited tax general obligation bonds (GO) – bonds that were supposed to be the ‘gold standard’ of the municipal bond market. Similarly, Puerto Rico defaulted on constitutionally guaranteed bonds in 2016 and forced creditors to take a significant haircut. Bond insurance can help investors reduce such risks by covering principal or interest losses caused by a state or local government that fails to make timely payments on its bonds.

In this article, we will look at how bond insurance can be used to protect against unexpected losses in the municipal bond markets.

Bond Insurers Come to the Rescue During Bankruptcy

Corporate bankruptcies are relatively straightforward with a well-defined list of creditors that appear in a logical order. By comparison, municipal bankruptcies are messy endeavors that can take years to complete, with numerous stakeholders and creditors fighting in court. These parties must also keep in mind that a municipality needs to continue to serve the public, which means that it’s not as simple as a corporate liquidation event.

Once in bankruptcy, a municipal debt issuer generally stops making principal and interest payments to bondholders until the court approves a plan of adjustment. The process of developing an approved plan is complicated and can take months or years. In the case of Detroit, problems began to surface in 2011 and a final plan wasn’t put into place until 2014, at which point uninsured unlimited tax GO bondholders ended up receiving only 74% recovery of the value of their bonds. This is when bond insurers came to the rescue of investors whose bonds were insured.

While protecting their policyholders from payment interruptions, bond insurers generally have more legal and financial resources to deal with a municipal bankruptcy than individual investors, which means that they tend to recover more than what individual uninsured bondholders do. In fact, bond insurance providers have departments dedicated to identifying any problems with an issuer before defaults or bankruptcies occur. Moreover, it is in the best interest of bankrupt municipalities to cooperate with insurers since an insurer’s financial strength and market acceptance may be required to regain access to the market after the municipality emerges from a bankruptcy procedure.

Is Bond Insurance Worth the Cost?

This can be best illustrated by an actual case.

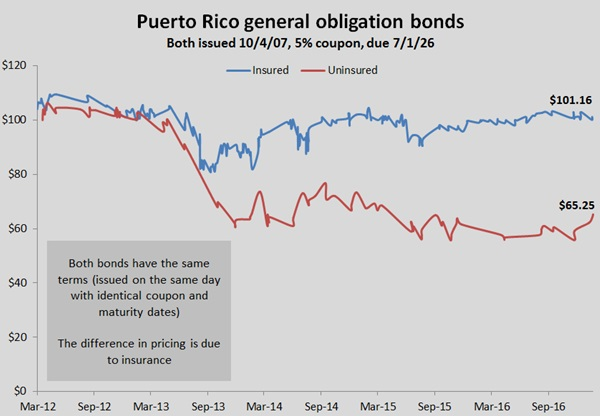

Consider Puerto Rico’s default on $2 billion worth of general obligation bond payments in July 2016 that made it the Commonwealth’s first-ever default on a constitutionally guaranteed debt. Despite the historic default, insured bondholders were paid in full and the bonds themselves experienced less price volatility and more market liquidity than their uninsured counterparts – the price of insured bonds traded at 100 cents on the dollar compared to as low as 63 cents on the dollar uninsured.

Insured vs. Uninsured Bonds in Puerto Rico

The cost of bond insurance is apparent in slightly lower bond yields in normal conditions, but many investors in the recent past have seen that insurance is well worth the cost. Bond insurance has certainly demonstrated its value in cases like Puerto Rico and Detroit, as well as several other instances in which municipalities have defaulted. But even in cases where bonds did not actually default, bond insurance helped reduce price volatility and increase market liquidity, saving investors from the risk of shrinking bond value under adverse scenarios.

How Does the Benefit of Bond Insurance Materialize?

In exchange for a reduced yield, insured bonds provide several critical benefits unavailable in uninsured bonds when it comes to bankruptcy or near-bankruptcy-like situations. Key benefits to watch out for are discussed below.

- Reliable Repayment – Insured bonds ensure that investors receive full, on-time interest and principal payments, even if the issuer defaults and no matter the length of the bankruptcy proceedings. For instance, investors holding insured Puerto Rican bonds received timely payments when the Commonwealth defaulted, whereas uninsured bondholders struggled to receive anywhere close to the full value of their investments.

- Consistent Market Liquidity – Insured bonds are easier to buy and sell at reasonable prices during times of uncertainty since they are significantly easier to value, given their guaranteed payment structure. Consider the prices of insured Puerto Rican bonds. These fluctuated significantly less than the prices of uninsured bonds, suggesting that price discovery was much simpler for insured bonds and investors were willing to transact.

- Reduced Reinvestment Risk – The assured payment structure of insured bonds means that investors can capitalize on other opportunities with the coupon payments, whereas any missed payments could translate to opportunity costs when it comes to uninsured bonds. For instance, the payments received by investors in the aforementioned Puerto Rican situation means that they could have reinvested the capital into new interest-bearing bonds and continued generating regular income.

- Protection From Downgrades – Insured bonds would not typically be downgraded based on the downgrade of an issuer, which helps sustain their liquidity and price when municipalities experience trouble. For instance, Detroit was downgraded to junk status in July 2013 after it filed for bankruptcy, but the value of bonds insured by a highly rated bond insurer didn’t suffer like the value of uninsured bonds did in the aftermath. Investors knew that insured bonds would pay 100% of interest and principal, while uninsured bonds were exposed to the significant losses that eventually materialized.

In addition to these benefits, the very presence of bond insurance can be an important sign of safety for bondholders, because bond insurers generally will not guarantee a bond that is below investment grade when insured, and they conduct sophisticated credit underwriting for their own protection. Most municipal bankruptcies affect bonds that insurers would not insure in the first place – despite the recent high-profile cases. Additionally, unlike an individual, a guarantor has the resources to monitor each issuer’s financial condition, to seek remediation before a default occurs and, when necessary, to pursue strong enforcement of covenants, security features and recovery rights.

The Bottom Line

The municipal bond market may be well known for its stability during times of crisis, but there are pockets of the market that have significant risk. Investors may want to consider bond insurance to eliminate the risk of default and to support market value in cases where bonds run into trouble. Either way, insurance can help avoid the risks that may arise from an adverse credit crisis that a bond issuer may face for a multitude of reasons.

Disclaimer

Sponsored by Assured Guaranty Municipal Corp., Municipal Assurance Corp. and Assured Guaranty Corp., New York, NY. This article is for informational purposes only and does not constitute (a) an offer to sell or a solicitation of an offer to buy any security, insurance product or other product or service, (b) financial, tax, legal, investment or accounting advice, or © advice with respect to any municipal financial products, or the issuance of any municipal securities, including with respect to the structuring, timing or terms of any such financial products or issuances. None of the sponsors or any of their affiliates is acting as an advisor in connection with any municipal financial product or any offering of municipal securities.